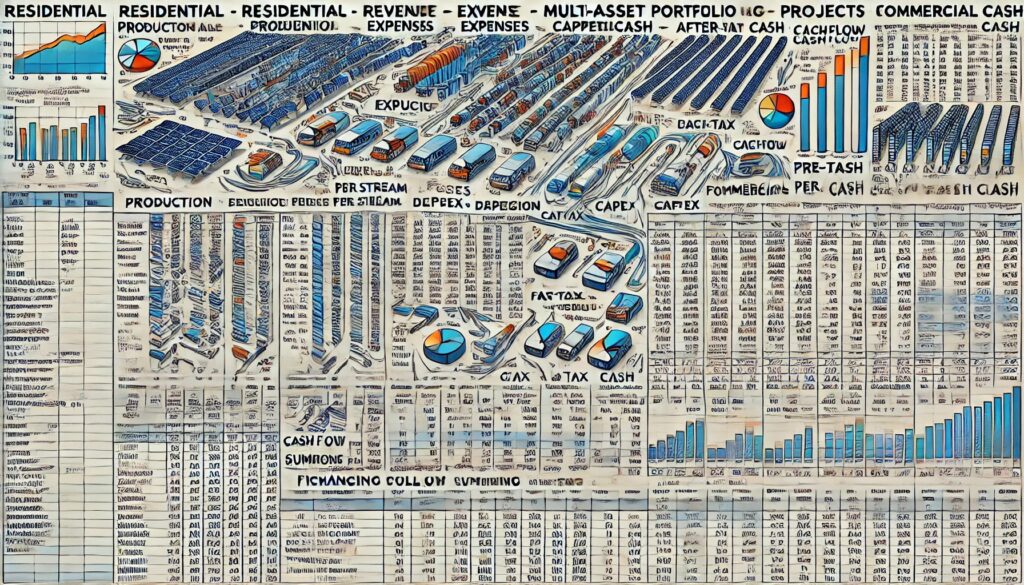

Special complexities arise when trying to model a number of similar assets. We see this in residential solar, commerial solar, and sometimes in utility-scale projects that combine renewable energy production with energy storage or end up adding additional projects to what are initially conceived of as single projects.

There are a few ways to organize models for such portfolios.

- Residential: Projects in this category are usually grouped into finding tranches; monthly or quarterly. Each tranche would summarize the production, revenue, expenses, and CapExfor each project. The goal is to keep the same number of project slots in each tranche so that a roll up sheet can be set up to summarize the values in each tranche. Then the roll up sheet can further calculate depreciation and other economic benefits and then layer in the financing.

- Commercial per stream model: In this type of model, you want to set up a tab for each stream, with each project listed and summarized. There would be a tab for production, revenue, expenses, CapEx, depreciation, tax credits, pre-tax cash and after-tax cash. Then the cashflows can be used in the structuring tabs to analyze the financing.

- Commercial per project model: This is our preferred and default method, which involves creating an identical project cash flow tab for each project. Then only the needed line items can be rolled to the financing tabs.

In all these methods, the key is have the tabs being rolled up be identical so the Excel formulas for the roll up are all uniform.